Pension funds around the world are significantly underinvested in infrastructure and will help drive growth as they invest more capital in assets that will be part of the global energy transition, according to a report by IFM Investors.

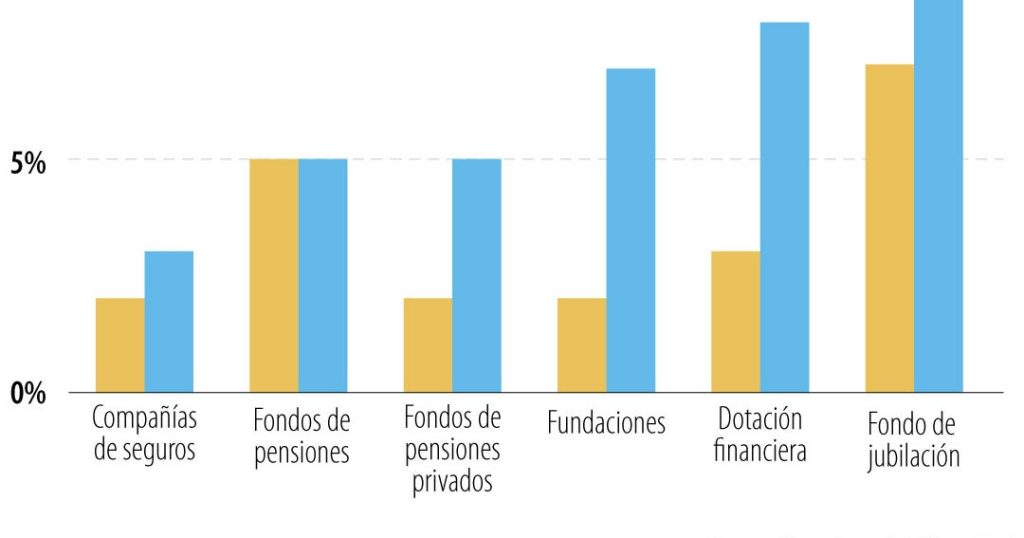

The path to cleaner fuels offers a “huge opportunity” for investors as more than $65 trillion will be needed over the next three decades to restructure the economy.said IFM chief strategy officer Luba Nikulina in the report from Melbourne-based global infrastructure company. Private sector pensions globally need to increase infrastructure investment from the current 2% to reach their 5% targetwhile Australian superannuation funds require a 7% increase to the 10% target, the report showed, citing data from Preqin Global.

“It is evolving globally as a stand-alone asset class,” he said in the report. “As interest in infrastructure increases around the world, the time has come to consider it as vital to the performance of institutional investors' portfolios as more traditional asset classes.”

Ports, power transmission infrastructure and train stations are being added to infrastructure portfolios, in addition to more traditional core assets such as airports, Nikulina said. Expanding the definition of infrastructure to include them provides an “additional universe of opportunities” that can give investors a cushion during market cycles.

Alberta Investment Management, one of Canada's largest institutional investors, is increasing its exposure in Asia by leveraging infrastructure assets, the firm's head in Singapore said on Tuesday.